8452059221 How to Invest Like a Pro in 2025

In 2025, mastering investment success requires an analytical approach rooted in technological innovation and strategic diversification. Professionals leverage advanced tools like quantitative analysis and automated trading systems to navigate complex markets with precision. Incorporating emerging asset classes such as cryptocurrencies and alternative investments enhances resilience and growth potential. Understanding evolving market trends through sentiment analysis and pattern recognition is essential for strategic positioning. The question remains: how can investors optimize these strategies to secure sustained financial growth amid rapid change?

Embracing Advanced Investment Technologies

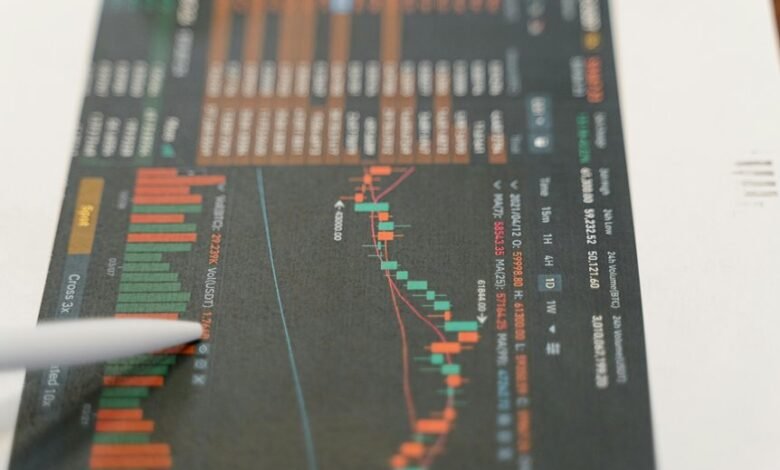

As technological innovation continues to reshape financial markets, embracing advanced investment technologies has become essential for professionals seeking a competitive edge.

Leveraging quantitative analysis and automated trading systems enables strategic, data-driven decisions that optimize performance and mitigate risks.

This approach grants investors greater autonomy, empowering them to navigate complex markets with precision and confidence.

Diversifying With Emerging Asset Classes

How can investors enhance portfolio resilience and growth prospects in 2025? Diversifying with emerging asset classes like cryptocurrency portfolios and alternative investments offers strategic advantages.

These assets provide uncorrelated returns, fostering financial independence and adaptability. Incorporating them enables investors to optimize risk-adjusted growth, supporting a resilient, freedom-oriented portfolio aligned with evolving market dynamics.

Analyzing Data-Driven Market Trends

Analyzing data-driven market trends has become essential for making informed investment decisions in 2025, as markets are increasingly influenced by complex, rapidly evolving patterns.

Employing quantitative analysis and sentiment analysis enables investors to identify strategic opportunities, assess risks, and maintain independence.

Mastery of these techniques empowers individuals to navigate uncertainty with confidence and strategic foresight.

Conclusion

In 2025, mastering cutting-edge technologies and diversifying across emerging assets are essential to navigating complex markets. By harnessing data-driven insights and advanced trend analysis, investors can position themselves ahead of the curve, transforming market challenges into opportunities. This strategic approach acts as a compass in turbulent financial waters, guiding investors toward resilience and growth. Embracing innovation and analytical mastery ensures a robust foundation for long-term success in the evolving investment landscape.